“The difference between tax avoidance and tax evasion is the thickness of a prison wall.” (Denis Healey, former UK Chancellor of the Exchequer)

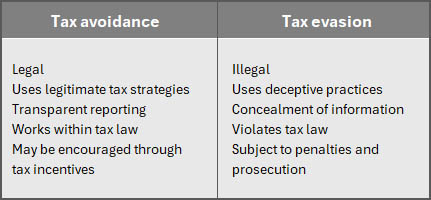

The line between tax avoidance and tax evasion can sometimes appear blurry, especially in complex transactions or fierce tax planning strategies. The comparison below is a good starting point:

What is tax avoidance?

Tax avoidance refers to legal arrangements or transactions designed to reduce or eliminate tax liability, without breaking the law.

Examples of tax avoidance include:

- Moving a company into a special economic zone for the sole reason of achieving a lower corporate income tax rate.

- Timing the sale of capital assets to control the timing of capital gains and losses.

- Getting your company to pay for a motor vehicle or other expenditure as it may, depending on the circumstances, be taxed at a lower rate.

- Placing a large amount of your income into a retirement fund to obtain the highest deduction possible.

- Investing in tax-free savings accounts (this applies to individuals only).

Often termed “permissible tax planning”, tax avoidance is legal and accepted. However, when tax avoidance becomes overly aggressive or artificial (i.e., lacking commercial substance), it may cross into what tax authorities consider “impermissible” or “abusive” tax avoidance. This, while not necessarily criminal, may be challenged under anti-avoidance rules such as the General Anti-Avoidance Rule (GAAR).

South Africa employs GAAR to counteract tax avoidance strategies that exploit loopholes. These rules allow tax authorities to disregard or re-characterise transactions that have the primary purpose of avoiding tax.

What is tax evasion?

Tax evasion is characterised as the illegal act of deliberately and intentionally avoiding paying taxes, either by avoiding paying tax entirely, or by illegally reducing or deferring taxes payable. It can involve hiding or ignoring one’s tax liability by making false representations or statements, or hiding income or information that would otherwise be subject to taxation.

Examples of tax evasion include:

- Failing to file required tax returns

- Making false statements on tax returns

- Failing to declare income or deliberately underreporting income

- Claiming personal expenses as business expenses

- Over-declaring expenses, which may include falsifying invoices

- Using multiple entities without legitimate business purpose

- Moving money through multiple accounts to obscure its source

SARS uses data-driven insights, self-learning computers, and artificial intelligence to combat tax evasion, and is empowered to conduct criminal investigations into tax offences and work with the criminal justice system to prosecute offenders.

Tax evasion can result in severe penalties of up to 200% of the shortfall in tax, plus interest, and even jail sentences of five years or more.

Best practices for legal tax avoidance

- Stay updated with ever-changing tax legislation to make informed decisions.

- Structure your business operations or transactions in a manner that legally minimises taxes – for example, operating as a sole proprietorship or a private company have different tax implications.

- Engage in permissible tax planning by adhering to all tax laws and regulations, and avoiding abusive tax schemes designed to exploit loopholes in the tax laws.

- Utilise all tax deductions, credits, exemptions and incentives, including deductions for business expenses, tax credits for certain investments or activities.

- Comply with reporting requirements and avoid penalties and interest by filing accurate tax returns on time.

- Maintain accurate records of all your financial transactions and tax-related documents to ensure all claims and deductions can be substantiated when required by SARS.

- Ensure transparency and full disclosure by always providing full and accurate information on tax returns: concealing information or providing misleading details can easily cross the line into tax evasion.

Best practice as a service

By adhering to these best practices, taxpayers can effectively employ tax avoidance strategies without crossing the line into the realm of tax evasion.

The best way to ensure all these best practices are implemented in your tax affairs is simply to work with our team of tax professionals. We are knowledgeable about the ever-changing tax laws and have the expertise and experience to provide tailored advice and solutions that keep you on the right side of the law while minimising your tax burden to the full extent permissible.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for specific and detailed advice.

© AccountingDotNews