If you’ve been searching “import licence requirements” or “documents for import export licence”, you’ve probably noticed the answers don’t always agree. Some pages treat it like one simple application, while others mix SARS and ITAC requirements together without explaining which one applies to you.

In South Africa, that confusion is normal — because “import/export licence” often refers to SARS Customs registration, and then only in certain cases you also need an ITAC permit for controlled goods.

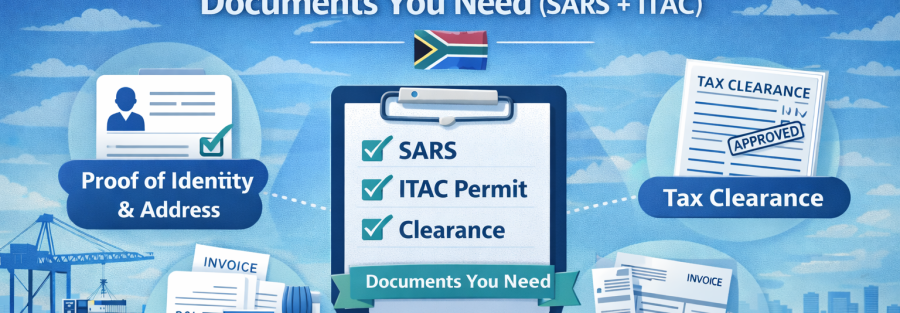

This guide breaks the requirements down in plain, practical terms. You’ll see exactly what documents you need for SARS registration, what changes when a permit is required, and what paperwork still matters at the clearance stage — so you can prepare the right pack upfront and avoid delays later.

Need a Professional Consultation & Assistance for Your Import / Export Licence?

Fiil the form below and we will be in touch shortly.

First, a quick clarity check: licence vs permit (because the requirements differ)

Most businesses asking for an “import/export licence” are really looking for SARS importer/exporter registration via the Customs Registration, Licensing and Accreditation (RLA) process.

An import or export permit, on the other hand, is typically an ITAC process for goods that are controlled/restricted — and government guidance for import permits explicitly starts with: register as an importer at SARS, then go to ITAC for the permit forms.

So the requirements depend on which of these you need:

- SARS registration requirements (almost always, for business importing/exporting), and/or

- ITAC permit requirements (only for specific goods/categories).

Need a Professional Consultation & Assistance for Your Import / Export Licence?

Fiil the form below and we will be in touch shortly.

SARS registration requirements (what to have ready before you apply)

SARS runs the customs registration process through eFiling / RLA, and SARS’s own RLA quick guide makes two things clear upfront:

- You need an eFiling Organisation profile (not just an Individual profile).

- You generally need to be registered for at least one active tax type before you can access Customs RLA (SARS specifically notes you can’t access Customs RLA without another active tax type first).

Supporting documents (what SARS will ask you to upload)

SARS’s Importers page lists key supporting documents that must accompany the application, including:

- Proof of address (e.g., a municipal account), and

- a certified copy of your identity document.

SARS also published guidance on what counts as acceptable proof for address/contact details (examples include a municipal account, fixed line or cellphone account, and other monthly statements that confirm the physical address).

And practically, if your contact/address items aren’t already “verified” in the system, SARS’s Customs Trader Portal guide notes you may be required to upload supporting documents for verification.

Special note if you’re a foreigner / non-local trader

SARS’s RLA webinar FAQs indicate that foreign applicants generally still need registered agent details to represent them, and that access to RLA still ties back to being registered for tax and having the right legal-entity setup.

Need a Professional Consultation & Assistance for Your Import / Export Licence?

Fiil the form below and we will be in touch shortly.

ITAC import permit requirements (only if your goods need a permit)

If your goods fall into a controlled category, you’ll need an ITAC permit. The Gov.za “Import permit for general goods” process starts with registering as an importer at SARS, then completing and submitting the relevant ITAC forms.

For ITAC importer registration, the ITAC IE230 form (application to register as an importer) explicitly states that for businesses, a SARS tax clearance certificate must be submitted.

ITAC also keeps a central page where application forms for import permits are listed (commercial purposes, personal use, and certain specialised categories like used vehicles).

ITAC export permit requirements (only if your goods need an export permit)

For exports that require permits, ITAC’s export permit form for general goods (IE361) shows what they ask for when the applicant is not already registered with ITAC as an exporter:

- IEPS 230 b (registration as an exporter with ITAC), and

- a copy of the company’s valid SARS tax compliance certificate.

In some export-control regimes (for specific controlled products), government gazette guidance shows additional “accompanying documents” can include items like:

- environmental operating permits (where required),

- a sworn affidavit (confirming the information is correct), and

- a valid SARS tax clearance certificate.

The big takeaway: permit requirements are product/category-specific, and the “extra documents” usually depend on what you’re exporting and why it’s controlled.

Need a Professional Consultation & Assistance for Your Import / Export Licence?

Fiil the form below and we will be in touch shortly.

The clearance-stage documents people forget to plan for

Even if your registration/permit is perfect, your shipment still needs the normal customs clearance paperwork.

SARS’s Imports guidance notes that the clearance process checks the goods declaration against documents produced such as invoice, bill of lading, certificate of origin, permits, etc., and that customs may request additional information or detain goods for other government departments where needed.

This is why we always separate:

- Registration/permit paperwork (setup), vs

- shipment paperwork (every shipment).

Quick documents checklist (keep this pack ready)

Here’s the clean “stack” most clients should prepare before starting applications. (This is the part that stops 80% of back-and-forth.)

- Identity documents (certified) for the applicant / authorised person

- Proof of address that SARS accepts (municipal account / monthly statement)

- SARS eFiling set up correctly (Organisation profile + correct user roles for RLA)

- At least one active SARS tax type in place before Customs RLA

- If ITAC importer registration is needed: IE230 + SARS tax clearance for businesses

- If ITAC export permit is needed: IE361 + (if not registered) IEPS 230b + SARS tax compliance certificate

- Shipment documents (for actual clearance): invoice, bill of lading/air waybill, certificate of origin where applicable, plus permits if required

Need a Professional Consultation & Assistance for Your Import / Export Licence?

Fiil the form below and we will be in touch shortly.

Why applications get delayed (and how to avoid it)

In practice, the common delay triggers are boring but predictable:

- Company details don’t match across documents (names, reg numbers, addresses).

- Proof of address is uploaded but doesn’t meet SARS’s acceptable standards.

- Tax clearance / tax compliance certificate is missing or expired.

- The goods description is vague (especially when a permit is involved).

- The applicant applies at the wrong authority (trying to “get a permit” when they’re not even registered properly yet).

If you treat your documents like a “pack” that must agree with itself, approvals go faster — and customs queries are easier to answer.

Need a Professional Consultation & Assistance for Your Import / Export Licence?

Fiil the form below and we will be in touch shortly.